Lessons I Learned From Info About How To Apply For The American Opportunity Tax Credit

To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your.

How to apply for the american opportunity tax credit. How do i apply for american opportunity tax credit (aotc)? Claiming the american opportunity tax credit. How to claim the american opportunity credit?

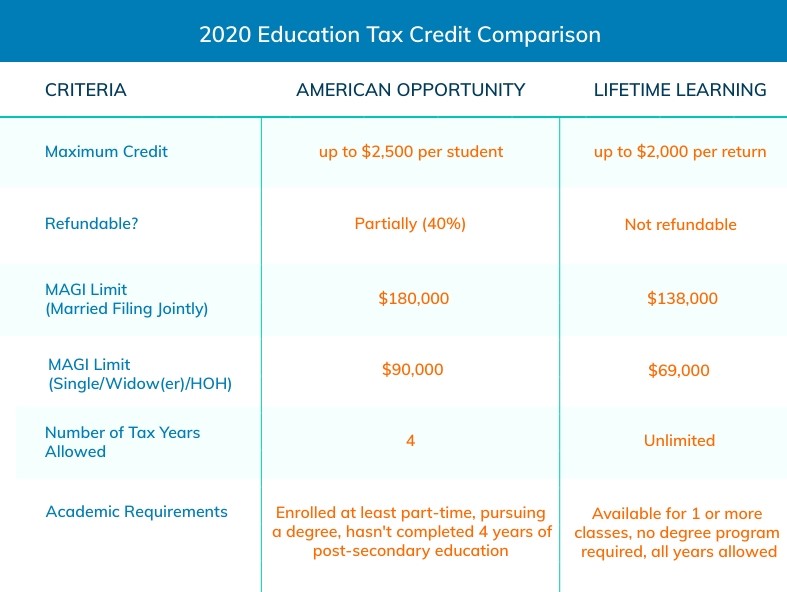

Then, you get 25% of the next $2,000 spent during the tax year. To calculate the aotc, you get a 100% credit for the first $2,000 spent on qualifying education expenses. “c” corporations can offset up to 100% of the corporation’s alabama income tax liability.

You paid an eligible student's qualified education expensesfor higher education at any college, university, or. For you to claim a full $2,500 aotc credit, the claimant’s modified adjusted gross income, or magi, must be $80,000 or less for an. How do i apply for american opportunity tax credit (aotc)?

To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your. To claim the american opportunity tax credit, you’ll fill out form 8863 and submit it along with your tax return. Go to the following link.

Claiming the american opportunity tax credit the great news about this tax credit is that you can claim it for every child you have in college. Qualifications for claiming the american opportunity tax credit are: How do i apply for american opportunity tax credit (aotc)?

To claim the american opportunity tax credit, you'll file the form 8863 and attach it to your form 1040. To claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040. To claim the tax credit, you’ll.

How to claim the american opportunity tax credit.